Policy Bazaar I Acquisition project by Smit Kamdar

Product: Policy Bazaar Life Insurance B2C

Policy bazaar is an online insurance web aggregator providing compare and buy platform for customers to compare multiple insurance products, make a selection and complete end to end purchase journey

About the Product:

Life Insurance arm of Policy Bazaar currently is at the matured scaling stage - they dominate ~90% of the direct to customer insurance purchase in the country. The product sees interest from over 1 crore potential customers visiting the website and eventual over half a million purchasing the product. the company runs two lines of business under Life insurance: Term product and Savings product

For the scope of this project, we will be picking Term product category given the category is growing at a comparatively faster rate of ~50%, the focus is to improve insurance penetration in the country with the Term category uptake and lastly it is more looked up on by the customers online in terms of research, affiliations and comparisons.

Definition of Term Insurance: Pre-agreed sum amount (basis the policy premium paid) is given to the nominee in case of the death of the policy holder.

Acquisition stage of the product:

Policy Bazaar is currently in the matured scaling stage. The core focus is to identify channels which can help generate large customer footfalls / leads for the call center team to chase while staying within the quality expectation as well as ensure reducing / flatten Cost of acquisition . Currently Policybazaar is heavily dependent on Digital ads (Meta, Google searches, email campaign etc.) while also using some kind of cold data.

During my interaction with Ms. Santosh Agarwal - Chief Business officer Life insurance at Policy Bazaar, there were 2 insights / problem statements which i came across are:

- Acquiring higher quality users online - ~1.2 cr+ Income tax filers still do not have any life insurance policy. Income tax filers are considered high quality users given ~70% are salaried with justifiable income against the sum assured seeked in the term policy

- Scale customer acquisition for non-conventional users like Self employed (with low income tax filing), Homemakers etc.

Let's get started:

Understanding the Ideal Customer Profile

For this understanding, there was a a quick survey link (https://www.surveymonkey.com/r/NJT57H9) put out which received responses from 18 folks who have purchased Life insurance policy online. Below are the quick results:

- 67% of the folks are in the bracket of 25-25 (with majority falling between 30-25)

- 70% of the users are salaried, 20% are self employed and balance either student or homemaker

- 80% of the users are married with 15% of them are with young children

- 85% of the users have an annual income range of over 15 lacs and balance are between 5-15 lacs

- 76% of the users stay in Tier 1, 12% in Tier 2 and balance in Tier 3

- 100% of the users are comfortable making their other investments like Mutual funds, Stocks, FD online using the intermediary apps

- 44% of the users like to do their investment research themselves via Google search, Blogs, Podcasts etc. , 22% take recommendation from current trusted app and the balance are influenced by social media

- Most users have seen Insurance ads on social media - Meta & linkedin

- Top decision making factor while purchasing insurance is the policy feature & the brand being promoted

In addition to this, i met up / spoke to ~27 users around me to understand some other factors of an ideal customer profile. some of them are listed as below:

- Most users think of Life insurance after a particular milestone in like - Marriage or kids

- These users are also searching for some other milestone related gaols like child plan, child education expense, house property rates in their individual areas etc. this could be a good surrogate

- The potential customer base is active across social platforms, open to engage with digital RM's as well as open to purchase via "DIY" journey

- All the users are comfortable purchasing via both app as well as web journey

- Fear (Particularly post COVID), uncertainty of future income, family security are some reasons driving the urge to research and buy life insurance

Basis all of the above below are two kinds of customer profiles created:

| ICP 1 | ICP 2 |

|---|---|---|

Age Group | 30- 40 | 25-35 |

Income range | >15 lacs | 10- 15 lacs |

City | Tier 1 | Tier 1 & 2 |

Occupation | Salaried | Salaried & Self employed |

Family details | Married | Single, Married |

Online investment traits | 100% confident in making investment online 75% of them can take a DIY journey | 70% - 80% confident |

Current touch points (in that order) | Google search, Podcasts, Referral, Meta, Linkedin | Youtube, Linkedin, Meta, Google search |

Key influencers | Intermediary investment apps Own research - Blogs, Podcasts Social media- Linkedin, Meta Peer recommendation | Digital ads Investment apps Peers & family Social media - Meta |

Key blockers | Clarity in communication needed Clear Give & get to be shown Trust missing - Hidden T&C's | Simplified communication missing Trust issues - problem of over communicating |

# | Adoption curve | Frequency of use | Appetite to Pay | TAM | Distribution potential |

|---|---|---|---|---|---|

ICP 1 | Low | Low | High | High | High |

ICP 2 | Medium | Low | Medium | High | High |

Now that we have two ICP's identified for the product, let's understand if the product has room to acquire more customers

What is the TAM for a life insurance policy to be bough online: Since Insurance industry is in its matured scaling stage, i am going ahead with a Top-down approach to calculate the potential TAM

# | Numbers |

|---|---|

Indian population (as on June'24) | 144 crs |

% of Population between 25 to 40 | 50%-55% |

Population eligible between 25 to 40 | 70 crs |

A - Income tax filers / Payers (basis current 5%) | 3.5 crs |

B - Others with disposable income but no returns filed (~5%) | 3.5 crs |

A + B - TAM | 7 crs |

Penetration within the eligible base @5% - SAM | 35 lacs customers |

Avg Life insurance premium | 25,000 |

Total Market potential | 8750 crs |

Sources: https://www.investindia.gov.in/sector/bfsi-insurance, Worldometer, https://policyholder.gov.in/indian-insurance-market

Core proposition of the product: Sum of money given to the designated beneficiary in case of the death of the insured person.

Keeping the ICP in mind along with the TAM opportunity, let's figure out the Right Acquisition channel

Through the right acquisition channel, we are trying to find a solve for below of the two problem statements:

- Acquiring larger volumes of customers online via top ranking amongst the most popular keywords used for term insurance considering the TAM detailed above

- Increasing awareness via Paid advertisements and partner integrations to reach out to a potential / new user base with better conversional ratios as well as quality

What are some of the traits demonstrated by ICP 1:

- Believe in their own research - Over 50% of the users believe in researching themselves before making the purchase decision - google search being the top preference

- 100% comfortable in doing an online journey with low need of physical assistance

- Spends time on investment & other ecosystem apps like Investment apps (Groww / Zerodha, Banking), Mobility (Ola / Uber), Medical & Pharma (Practo / netmeds), Groceries (Swiggy / Zomato), OTT (Netflix / Prime), Food Delivery (Zomato / Swiggy) etc.

- Also, as per Deloitte 2020 insurance outlook - 93% of the customer buying policy online start with a search engine result

Keeping all of the above in mind, organic search continues to be one of the most preferred way to acquire large volumes of customer. while Policy bazaar currently focuses on their SEO strategy to acquire over 50% of their customers online, there is still some room to optimize and win on rankings.

Organic search will be our 1st acquisition channel with the objective to solve for large customer acquisition as one of our first problem statements. While solving for this, we will also try and address the concern raised by the CBO at Policy Bazaar on acquiring large volumes with quality for better conversions

Another reason to believe for considering organic search as one of the important channels of acquisition is given the potential to scale, flexibility to scale up / down with a potential to reduce cost of acquisition with some smarts on articles, content, search words etc.

Channel | Cost | Flexibility | Effort | Lead time | Scale |

|---|---|---|---|---|---|

Organic search | Medium to High | High | Medium | Medium - High | High |

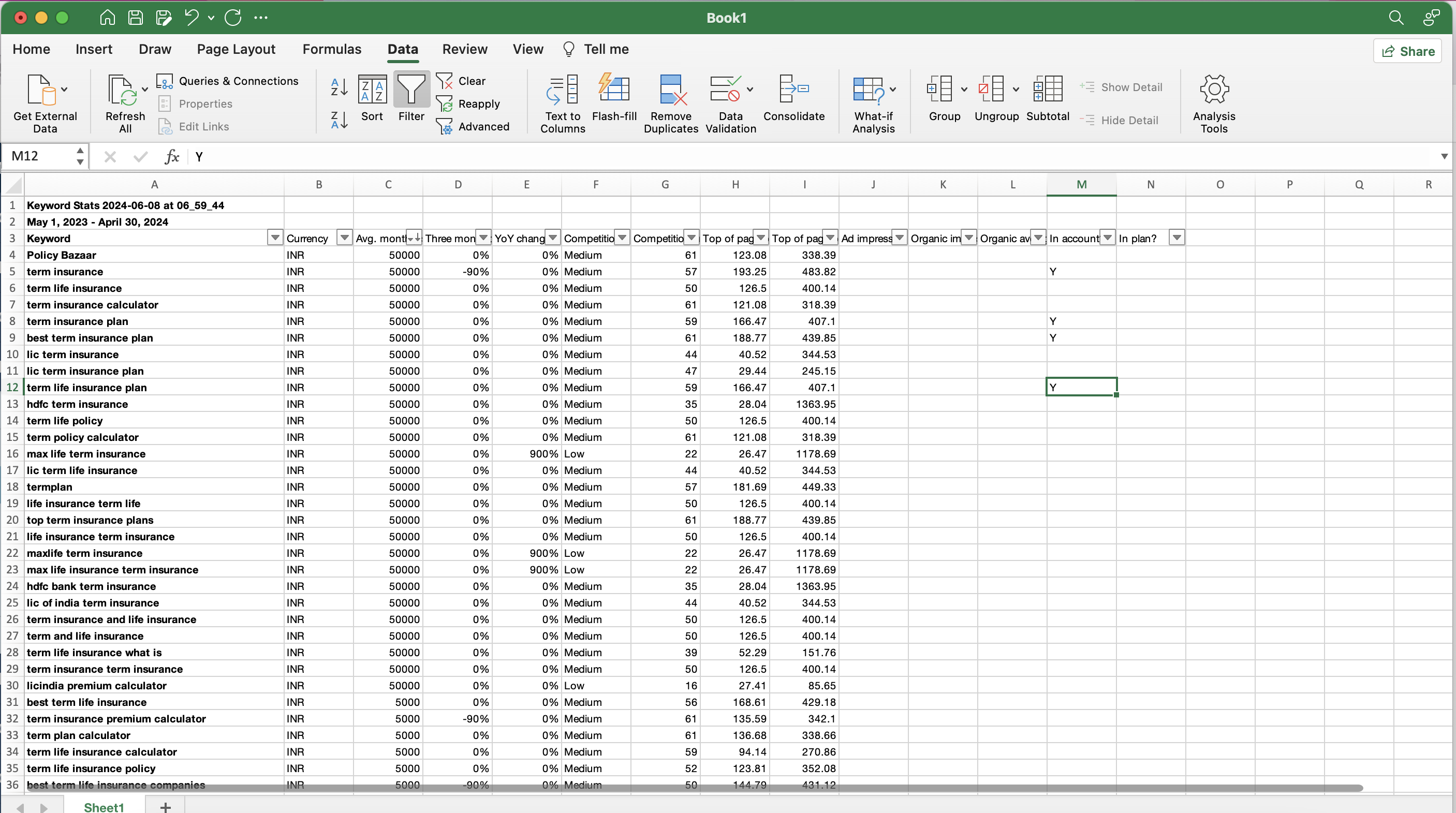

Top key words basis the avg monthly searches used for Term Insurance:

Term Life Insurance

Term Insurance

Best life insurance

Best Term life insurance

Term insurance calculator

Policybazaar

LIC life insurance

Max life term insurance

Cheapest term life insurance

Source: Keyword planner - Google ads and Keyword research & SERP analysis - Moz

Basis the above keywords, have collated the insights in a measurable format to understand the entire funnel in detail:

Type of search | Keyword | Search volume (avg monthly) | Impressions (Share of voice) | Difficulty to rank on seo | Avg cost per click | Projected Click through rate | Clicks | Click to session | Session to lead | Leads | Conversion rate | Conversions | Cost per website/app land | Website land to conversion rate | COA |

Use case | Term Insurance | 100000 | 60000 | High | 210 | 12% | 7200 | 4320 | 20% | 864 | 3.5% | 30 | 350 | 0.7% | 167% |

Competitor | Maxlife Term | 80000 | 24000 | High | 260 | 9% | 2160 | 1296 | 15% | 194 | 2.0% | 4 | 433 | 0.3% | 481% |

Your product | Compare and buy | 90000 | 54000 | High | 50 | 30% | 16200 | 9720 | 30% | 2916 | 7.0% | 204 | 83 | 2.1% | 13% |

Your brand name | PolicyBazaar | 100000 | 90000 | Medium | 40 | 30% | 27000 | 18900 | 30% | 5670 | 8.0% | 454 | 57 | 2.4% | 8% |

Use case | Best term life insurance | 100000 | 60000 | High | 250 | 15% | 9000 | 5400 | 20% | 1080 | 4.0% | 43 | 417 | 0.8% | 174% |

Competitor | Icici term life insurance | 70000 | 21000 | High | 280 | 10% | 2100 | 1260 | 15% | 189 | 2.0% | 4 | 467 | 0.3% | 519% |

Your product | Cheapest term insurance | 100000 | 70000 | High | 100 | 25% | 17500 | 10500 | 30% | 3150 | 6.0% | 189 | 167 | 1.8% | 31% |

Your brand name | PolicyBazaar | 100000 | 90000 | Medium | 80 | 35% | 31500 | 22050 | 30% | 6615 | 7.0% | 463 | 114 | 2.1% | 18% |

Use case | Term Insurance calculator | 60000 | 36000 | High | 200 | 15% | 5400 | 3240 | 20% | 648 | 3.0% | 19 | 333 | 0.6% | 185% |

Competitor | Max life Term calculator | 50000 | 15000 | High | 230 | 10% | 1500 | 900 | 15% | 135 | 1.5% | 2 | 383 | 0.2% | 568% |

Your product | Cheapest price, online discount of 10% | 50000 | 30000 | High | 50 | 30% | 9000 | 5400 | 30% | 1620 | 7.0% | 113 | 83 | 2.1% | 13% |

Your brand name | PolicyBazaar term calculator | 60000 | 54000 | High | 40 | 35% | 18900 | 13230 | 30% | 3969 | 8.0% | 318 | 57 | 2.4% | 8% |

Use case | term life insurance | 100000 | 60000 | High | 240 | 15% | 9000 | 5400 | 20% | 1080 | 4.0% | 43 | 400 | 0.8% | 167% |

Competitor | HDFC best term life | 80000 | 24000 | High | 300 | 10% | 2400 | 1440 | 15% | 216 | 2.0% | 4 | 500 | 0.3% | 556% |

Your product | Compare and buy term insurance | 90000 | 63000 | High | 150 | 25% | 15750 | 9450 | 30% | 2835 | 6.0% | 170 | 250 | 1.8% | 46% |

Your brand name | PolicyBazaar | 100000 | 90000 | Medium | 125 | 30% | 27000 | 18900 | 30% | 5670 | 7.0% | 397 | 179 | 2.1% | 28% |

Use case | 1 cr term insurance | 70000 | 42000 | High | 200 | 13% | 5460 | 3276 | 20% | 655 | 3.0% | 20 | 333 | 0.6% | 185% |

Competitor | Icici pru 1 cr term cover for 460 pm | 50000 | 15000 | High | 220 | 10% | 1500 | 900 | 15% | 135 | 1.5% | 2 | 367 | 0.2% | 543% |

Your product | Cheapest price, online discount of 10% | 50000 | 30000 | High | 60 | 25% | 7500 | 4500 | 30% | 1350 | 7.0% | 95 | 100 | 2.1% | 16% |

Your brand name | PolicyBazaar best buy 1 cr term cover | 60000 | 54000 | High | 50 | 30% | 16200 | 11340 | 30% | 3402 | 8.0% | 272 | 71 | 2.4% | 10% |

Key Insights from the searches and current utilisation report:

- On 3 of the top 6 key word searches like Term insurance online, term life insurance etc. policy bazaar does not feature in the top 2 ranking (sponsored) as well as organic

- Max life insurance and Icici prudential life insurance dominate the top ranking (organic + sponsored) given the following reasons: Immediate calculator landing page (to view premium and features), simplified communication as compared heavy communication from policy bazaar, simplified UX etc.

- With the air cover from Digital / brand campaigns, policy bazaar as a keyword has searches over 4 lacs / month and has over 80% click to session rates - This must be capitalised.

- Only issue - despite heavy traffic on Policy bazaar keyword - some of this traffic gets re-directed to Insurance company website. Hence, strong hooks needed to keep the customer engaged and acquired on the policy bazaar website itself

What are some of the Friction areas / Opportunity to influence ranking?

- Need to influence ranking to appear on the top search links - higher footfall on policy bazaar website

- Ring fence customers on Policy bazaar website to improve clicks --> visits --> leads --> conversions

Core USP of Policy bazaar that aligns with our ideal customer profile:

# | Policy Bazaar USP | ICP expectation |

|---|---|---|

1 | Option to compare & Buy | Likes to do own research before making the decision |

2 | Best of the plan from different insurance companies available at one stop | Simplified & Authentic information needed Information to be validated by influencers |

3 | Acquisition time | Expectation to receive information within no time |

1st Experiment:

For over last couple of years, online term insurance segment has been dominated with the cheapest 1cr term cover being promoted with the subsequent pricing war propositions and top search results showing similar results as seen below:

Experiment is to a create a new Search category aorund 2 crs Life cover with the following rationale:

- 2 crs of Life cover can be given to any individual below 40 yrs of age and over 10 lacs of annual income in a simple DIY journey without complicated interventions

- Over 70% of the ICP's covered through survey and other conversations are in the income range of 10 lacs+

- When nudged about the 2 crs life plan, 80% of the respondents agreed to getting a higher life cover - but lack of information in this area restricted their choice

- Most amazing fact: 1 crs life premium / month for a 30 yr old is ~1300 INR and the same premium for a 2 cr life cover (2X life cover) comes at just 1900 INR (1.4X increase). Customer premium paying ability should not become a blocker here.

How will we go about doing this?

Begin with marketing a new concept call Life which resonates to the Life premium as well as provides a simple concept which can be extensively communicated too .

How much Life Insurance coverage is a good cover to have?

L: Liabilities

I: Income replacement

F: Final expenses

E: Education (most ICP are / will enter phase with young children)

This easy formula being communicated extensively will help users realise the need for an higher cover

Some headlines / user stories to pull traffic on popular keywords:

- Double your life insurance cover with just additional 500 / month

- Now 2X Life insurance cover comes at a cost of a Netflix subscription

- Beat Inflation with an adequate cover, Salary to security etc.

- Targeting earning females: Securing their future in your hands too

Leveraging Podcasts, news letters, website content etc, to build on this strategy.

Some key words to start building on this experiment:

- Bidding higher on 2 cr life cover / Insurance cover

- Bidding higher on cheapest term insurance

- Bidding on Best Insurance cover with the headline as:

BestIdeal Insurance cover. No Compromises

Landing page to be re-imagined with the L.I.F.E calculator. Focus on diverting entire traffic to the LIFE calculator. Currently entire traffic is directed to the quote generation page, quote to be integrated with calculator.

2nd Acquisition channel: Paid Advertising

Understanding the CAC: LTV ratio for a term life insurance product as below:

The CAC to LTV ratio is 1:3 with the current 1.5 of product density. With the density moving to 2, the CAC to LTV ratio will land around 1:4

Now, with this Paid advertising continues to be one of the largest acquisition channel in a B2C insurance industry

Channel | Cost | Flexibility | Effort | Lead time | Scale |

|---|---|---|---|---|---|

Paid Advertising | High | Low to Medium | High | Medium - High | High |

The 2nd problem statement we wanted to solve was around getting new users with a specified demographics in mind. This helps in right product positioning, brand awareness and quality lead generation.

Keeping this in mind, lets us plot the framework for the campaign to be launched:

# | Basis the selected ICP inputs |

|---|---|

Channel selection | Meta, Linkedin, Youtube, Google |

what does mine ICP look like? | Meta: 25-35 yr old I Tier 1 & 2 cities I Interests in financial information pages - mutual funds, stocks, how to build capital etc. Users to looking at new born pages / reels (child pitch), frequent travellers, users following health & lifestyle related topics etc. |

Campaign structure | Objective: Generate leads / interests for an outbound campaign Ad group: Basis the ICP description mentioned above |

Ad creative | Generate ~12% impressions to lead ratio |

With this let's look into experiments we want to run on Meta to meet our objective:

Experiment 2: We want to extensively target salaried professionals with minimum 5 lacs and above income, both in Tier 1 and 2 cities, between the age group of 25-40 years with the proposition of special product discount available for them

Campaign | Ad Set | Marketing Pitch |

|---|---|---|

Special salaried professional discount | Salaried : >10 lacs | As you support your family, here is a little from us too 15% discount on 1st year premium 2 cr Term cover starting 1000/ month |

Salaried: 5 - 10 lacs | Cheapest term cover starting 589* per month Exclusive 15% discount for salaried professional | |

Salaried: 30-40 years with children | Be there for every step that they take! 2 cr term cover starting 1000 / month 12% salaried employee discount on 1st year premium | |

Salaried: below 30 years | Start early, 1 cr term insurance starting at 25 / per day 10% salaried discount available online | |

Female salaried professional | Securing their future is in your hands too! 1 cr term cover starting 589 / month 12% online discount on 1st year premium for salaried professionals |

Have created some sample static mocks for Meta:

Experiment 3: We want to extensively target self employed professionals with minimum 5 lacs declared income, both in Tier 1 and 2 cities, between the age group of 25-40 years with the proposition of unique plans without the need of financial proof available for them

Awareness and penetration of Life Insurance is low in Self-employed as a segment. with the need to acquire new users to the Life insurance, Self-employed category needs to be promoted. This will need push marketing in reaching out these target cohort, building awareness and generating interests .

# | Basis the selected ICP inputs |

|---|---|

Channel selection | Meta, Youtube |

what does mine ICP look like? | Meta: 25-40 yr old I Tier 1 & 2 cities I Interests in financial information pages - owns a business account with Meta, interests in building businesses, users following health & lifestyle related topics etc. |

Campaign structure | Objective: Generate leads / interests for an outbound campaign Ad group: Basis the ICP description mentioned above |

Ad creative | Generate ~10% impressions to lead ratio |

For self employed, we will be using both Meta and youtube with below details:

Campaign | Ad Set | Marketing Pitch |

|---|---|---|

Special offering for Self employed | Self employed: >10 lacs | We have got you covered while you take care of your business No financial documents needed 50 lacs Term cover starting 500/ month |

Self employed: 5-10 lacs | As you take risky business calls, we have got your family secured No financial documents needed 50 lacs Term cover starting 500/ month | |

Salaried: below 30 years | Finding the right investor for your startup? We have found you the right investment for your family No financial documents needed 50 lacs Term cover starting 500/ month |

Sample static mock created for the self employed advertising:

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.